This post was last updated on 2020 April 30

Among the many things no one ever warns you about moving overseas is how managing money suddenly becomes a massive headache.

Most expats I know here in Australia now use their Australian bank account as their primary money hub, since they get paid in Australian dollars and spend in Australian dollars. Easy peasy.

But for me, and I’m guessing many other Americans, switching over completely to a foreign bank account isn’t a viable solution. I need to ensure I have adequate money in my US bank account to cover two major monthly payments: student loans and credit card bills.

I’m not able to pay either of these bills from my Aussie bank account, and I’m unwilling to get rid of my American credit card because of all the points and travel perks it offers (say what you will about the US, but we have the best credit cards for travel hacking!). Therefore, I need to move money from my Aussie bank account to my American bank account on a regular basis.

When I first moved here 3 years ago, I investigated several different options for money transfers before discovering THE BEST way to transfer money to my US bank account. Here’s what it looks like when you want to transfer AU$5000 to a US bank account a few different ways:

How NOT To Transfer Money

Bank Transfer

My first thought was to just transfer money straight from my Australian bank account (previously CommBank) to my US bank account (Wells Fargo) via bank transfer. Little did I know I’d be hit with not one but TWO bank fees:

- CommBank charges AU$12 (~US$9) per bank transfer when you debit from your Aussie account and exchange to a foreign currency.

- Wells Fargo charges US$16 to receive a foreign bank transfer.

On top of being hit with double fees, the exchange rate for an international bank transfer (at least with CommBank) is absolutely atrocious.

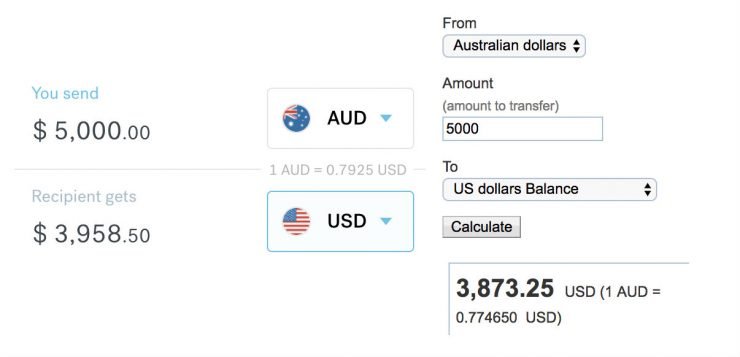

CommBank exchange rate.

TOTAL USD EXCHANGED: US$3777.50 – US$9 fee to send – US$16 fee to receive = $3752.50

PayPal

Next, I took to PayPal – a platform I’ve used before to make and receive payments with relative ease.

In order to move money from my Aussie account to my US account, I would need to create a new PayPal account on the Australian PayPal site and link it to my Australian bank account. Then, I could transfer money from this new Aussie PayPal account to my old US PayPal account. That’s slightly tedious, but not too bad.

The worst part, though, happens on the receiving end of the PayPal transfer. When you receive an international money transfer, PayPal charges you a fee (depending on the currency) and converts the money at a terrible exchange rate.

If I were to transfer AUD into my US PayPal account, PayPal would charge me 1% of that amount as a fee. So when moving $5000 over, I’d have to pay $50 for the transfer itself. Um, can you say big fat NOPE? AND, to add insult to injury, I’d lose even more money once I exchanged AUD to USD using PayPal’s awful exchange rate.

I think PayPal is fine to use if you’re moving over small amounts of money, but the larger the amount the more you’ll end up paying as a fee. For expats moving over large chunks of their wages to an overseas bank account, PayPal just isn’t a sensible option.

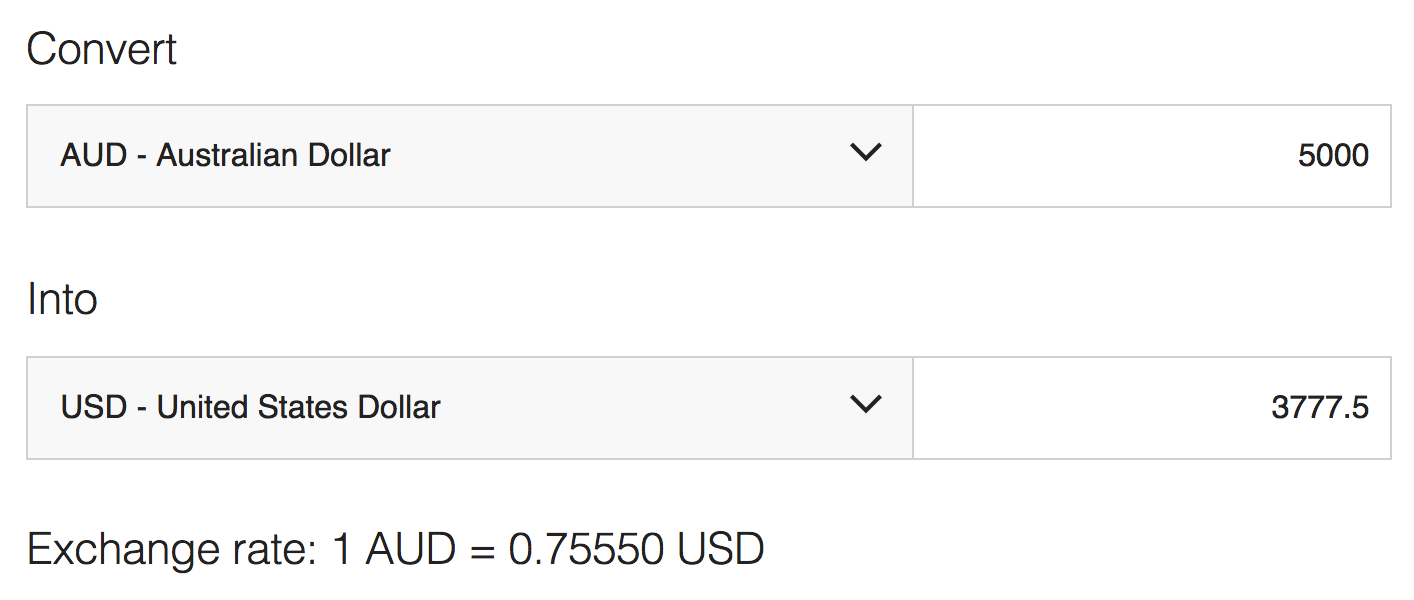

PayPal exchange rate.

TOTAL USD EXCHANGED: US$3,873.25 – AU$50 fee to send = $3834.52

Best way to transfer money: CurrencyFair

Thoroughly exasperated with the above options and the idea of throwing away upwards of $1000 a year on various money transfer fees, I mercifully found out about another international money transfer option from an old flatmate I had when I first moved to Sydney. He suggested CurrencyFair, a peer-to-peer online marketplace that lets you sell currency in exchange for buying another currency from someone else.

CurrencyFair essentially cuts out the middle man (the bank), charges a much smaller fee (just €3, or ~US$3.68), and exchanges the money at a very good rate. They also claim to be up to 8 times cheaper than banks when it comes to international money transfers. That was about all I needed to hear to give it a try!

Screenshot of my most recent transactions. It only takes a day for the money to make it to my bank once it lands in CurrencyFair – too easy!

At first I was a little confused by the peer-to-peer marketplace thing: would I be interacting and negotiating with other people in order to transfer my money through? It sounded like a bit of a hassle to me. BUT, in reality, transferring funds through CurrencyFair feels like doing a regular ol’ bank transfer. It couldn’t get much easier!

With both of my bank accounts linked to CurrencyFair, the process is roughly as follows and takes about 2 business days to complete:

- Log into CurrencyFair and initiate a transfer.

- Log into my Aussie bank account and transfer funds in AUD to CurrencyFair. (Very important that in the transfer notes you include your CurrencyFair reference number, so that they know who the money is coming from and can match it to your account.)

- CurrencyFair automatically exchanges the funds to USD and transfers to my US bank account (though if you don’t want this to be done automatically, you can just transfer into CurrencyFair and specify that the funds sit there until you go in and tell them to transfer to your other account… useful if you’d rather wait until the exchange rate is more favorable!).

I’ve been using and loving CurrencyFair for the past 2.5 years. It is the only way I transfer money from Australia to the US to pay all my bills. The ONE negative I’ve found, though, is that not all currencies are available for transferring (see full list here). This personally doesn’t affect me, but it could be an issue for those from or living in certain countries.

The good news is that they’ve been adding more and more currencies to their list over the years: case in point, when I first heard about CurrencyFair in early 2015, USD wasn’t an option… but then a few months later it was, and I was able to start using their service.

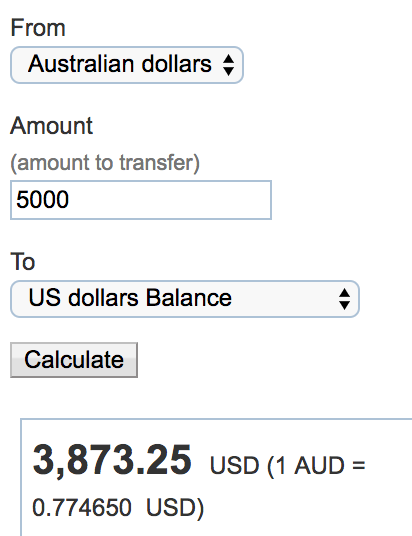

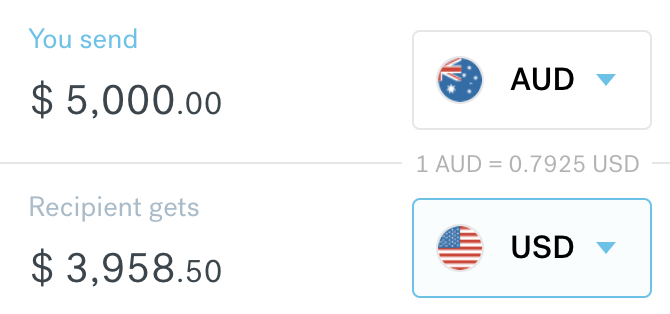

CurrencyFair exchange rate.

TOTAL USD EXCHANGED: US$3958.50 – €3 fee to send = $3954.82

The Bottom Line

Here’s how much money would end up in my US bank account if I were to transfer AU$5000 right now (16th January 2018) using the 3 options examined above:

- Bank Transfer: US$3752.50

- PayPal: US$3834.52

- CurrencyFair: US$3954.82

CurrencyFair saves me $200 over a normal international bank transfer. Multiply that by, let’s say, 6 transfers in a year (probably about what I average) and I save over $1200 per year. THAT IS INSANE.

If you’re a fellow expat trying to sort out their money situation between countries, I wholeheartedly recommend using CurrencyFair as the cheapest way to send money internationally. It’s one of the best ways I know to save money in Australia. Let me know if you have any questions about it in the comments and I’ll gladly help you out!

EXCLUSIVE TO FRUGAL FROLICKER READERS:

Sign up to CurrencyFair using this link and your first 3 transfers are free!