This post was last updated on 2020 April 30

There are many things that frustrate me about being an expat in Australia: the lack of Amazon Prime, the fact that my excellent US credit score means diddly squat and somehow I don’t qualify for any credit cards or financing here, not being able to log into several of my US accounts online because they require phone verification with a US phone number, how unbelievably difficult it is to vote in US elections, and constantly having to transfer money between my US and Aussie bank accounts – just to name a few.

But the biggest pain in the arse about being an American expat living in Australia? Having to file tax returns TWICE A YEAR. As if once wasn’t enough torture!

Yep, Americans are obligated to file a US tax return every year, even when they spend zero time in the US and do zero work for US clients, even if they permanently reside overseas… until and unless they decide to renounce their US citizenship.

Mercifully, the US has tax treaties in place with certain countries (one of which is Australia) which prevent expats from getting double taxed. So while I must file a tax return for both the US and Australia, I only actually pay tax to one country. Thank GOD for that!

Life as an expat is all fun and sunsets until it’s time for the next tax return.

I always completed my own tax returns when I lived in the US and, while it usually took me the better part of a day (and a bottle of wine, let’s be honest) to navigate TurboTax, it always felt manageable to me.

But now that I have two countries to report to, and an increasingly outside-the-box work situation to contend with, taxes have become infinitely more stressful for me. At this point, I am willing to pay someone else for the peace of mind of having my tax returns completed correctly.

In Australia, there are shockingly few accountants that specialize in both US and Australian taxes, which would have been ideal – but alas. There also aren’t that many accountants Down Under that are familiar with the US tax system, and those who do charge a premium for their services. I just wasn’t wiling to go from spending $0 to spending $1000 on a tax return, so that option was out.

That’s about when I found Taxes For Expats on one of my frantic Google searches. This company is US-based, but works exclusively with Americans living abroad – at an affordable rate, to boot!

Shortly after wrapping up my US tax return for this year, someone from the company reached out to me and asked if I’d be interested in writing an article for my blog about the Taxes For Expats process and benefits. I wanted to mention this because I want y’all to know that 1). I sought out and paid for their expat tax services first; 2). When they reached out to me, they were unaware that I was already a client of theirs.

All that to say, this is very much a genuine account of my experience working with Taxes For Expats. I hired them to file my US tax return on my own accord, and not because they wanted to work with me as a blogger. I’m happy to write about products and services I already use and love, and this is no exception.

Alright, now let’s get into it! Here’s what it was like working with Taxes For Expats on my US tax return while living in Australia – and how they saved me many a dollar and gray hair.

Expat Tax Services by Taxes For Expats

First, let me just say that the best thing about Taxes For Expats is how clear and easy their process is.

They have a pricing page that details all of their fees: it’s $350 for a basic tax return, + $100 if you have any self employment income, and + $75 for FBAR (which you need to file if you had at least US$10,000 total across all your non-US bank accounts at any point during the tax year). So straight away, I knew I’d be paying $450 for my US expat taxes before I even contacted them. (FYI I avoid FBAR by constantly moving money from my Aussie account to my US account using CurrencyFair, as my student loan payments and credit card bills all come out of my US account).

Anyway, I really appreciate when businesses are transparent with their pricing. I get that a lot of them don’t like to list their prices on their website so that people have to contact them and ask inquire their services, but I think that’s sneaky and quite honestly, I usually exit a website if I can’t find the prices right away.

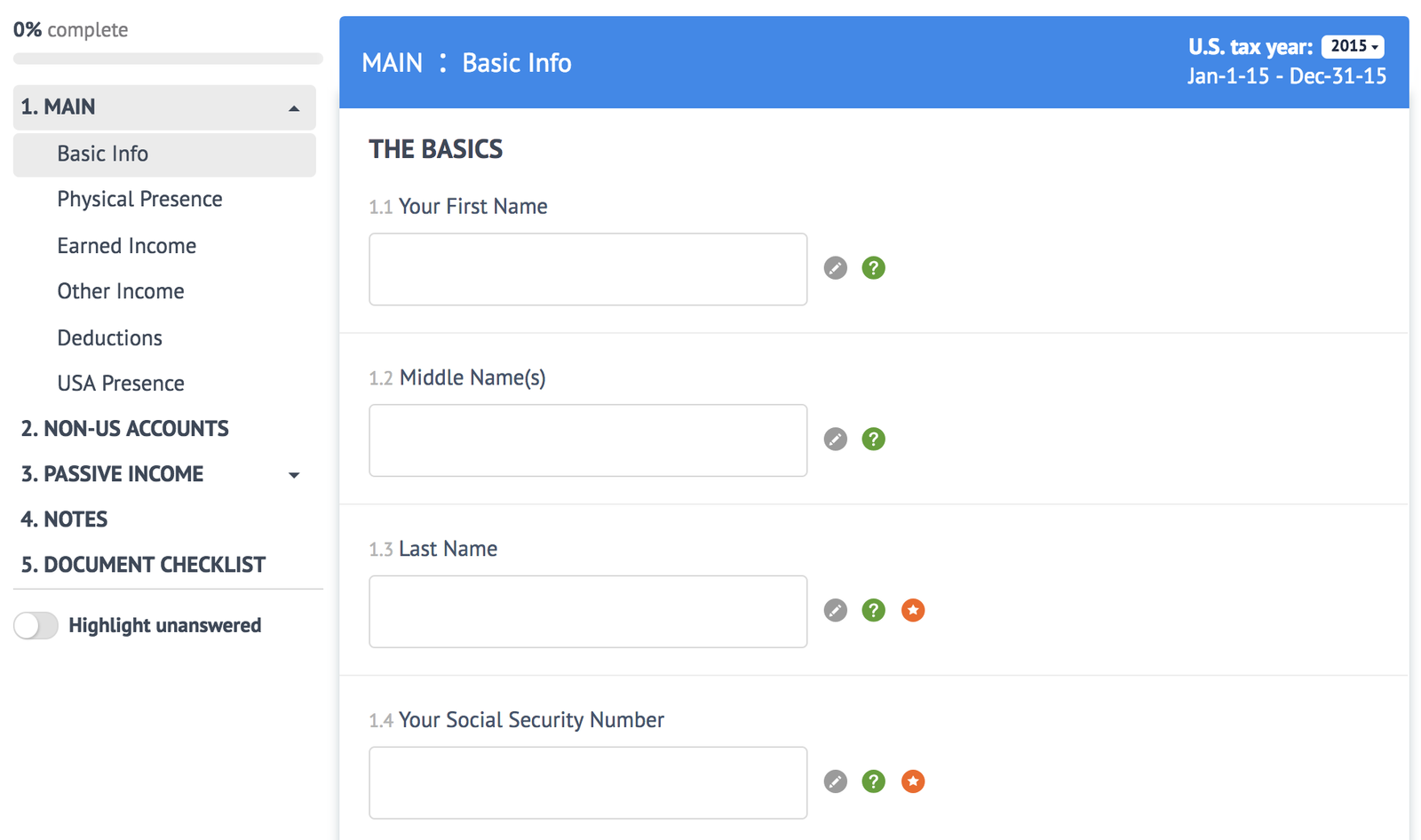

So once I figured out that I could afford their expat tax services, I read up on how their process works.

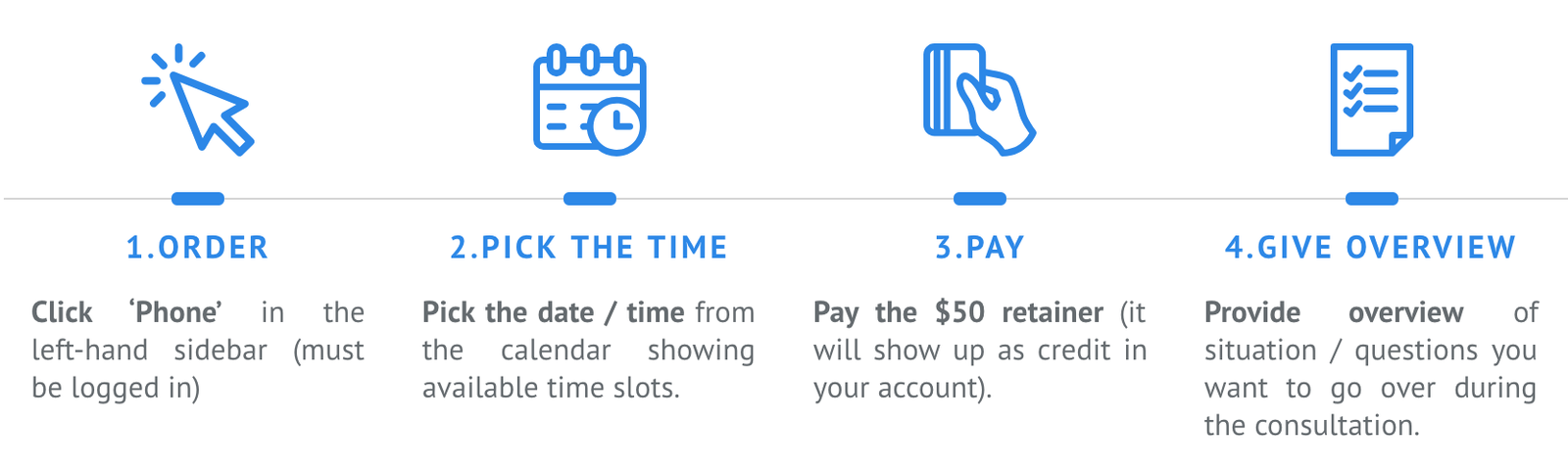

Thankfully everything is done online through their website and follows a set procedure, which is super convenient because 1). Coordinating phone calls and going back-and-forth with expats located all over the world can be tricky and not very time efficient, and 2). No need for e-mail chains! I’m into it.

Still, I was actually keen to take advantage of their optional 30 minute phone consultation – you pay $50 for it, but this gets credited toward the price of the tax return which I think is very fair. To get the most out of it, I’d recommend preparing a list of questions beforehand – I believe you can include these as notes when you book the consultation, which helps the accountant prepare some answers in advance of your call. I had a bunch of questions I wanted clarity on in addition to the overarching question of WHICH COUNTRY DO I PAY TAXES TO, such as whether I still owed US self employment tax, whether I needed to file a US state tax return, and if it would be beneficial to start a business in Australia.

The person I spoke to for the consultation was not the same person who completed my tax return, but he was very helpful and pointed out that I’d probably needlessly been paying US self employment tax the past few years. That ALONE saved me thousands of dollars. Note that Taxes For Expats can also file amended tax returns for you if you think you may have messed them up in previous years – this is especially worth doing if you’ll end up getting a tax refund that exceeds the cost of filing the amended return.

After the phone consultation, I felt good about hiring Taxes For Expats to complete my US tax return and decided to continue on with the next step in the process: filling out the questionnaire.

It is lengthy, but it kind of has to be since they need all your details in order to fill out your tax return, not to mention determine how best to minimize your taxes owed. It’s worth it to take the time to provide them with as many details and relevant documents as you can.

You’re able to upload documents and add notes to your questionnaire, both of which I highly recommend doing. In the notes, I wrote a few sentences explaining my living situation (from the US, permanently residing in Australia) and work situation (a shit show… just kidding! More like, multiple income streams and unable to fit in any existing box). I uploaded my tax returns from last year, my income and expense spreadsheets, and any tax forms I received related to my bank accounts and student loans.

Not too long after, my assigned accountant sent me an electronic engagement letter – basically a contract for me to read and sign, granting her permission to proceed with my tax return. The letter includes the total amount you’ll be charged for their services, but you won’t need to pay until after they finish their work. It took about two weeks for my tax return to be completed after signing the engagement letter. I wasn’t in a rush, as expats get an automatic two-month extension for filing.

Now, everyone’s tax situation is different, so this might not be what your US expat taxes look like… but for me, Taxes For Expats helped me determine the following:

- I now pay tax to Australia and not to the US anymore, so I didn’t owe any taxes on this return.

- I could have been penalized for contributing to my US IRA account while not having any taxable US income. I’m not sure how exactly this works, but my accountant took into account the dates of my recent visits to the US and determined that if she delayed filing my tax return until mid-August, I wouldn’t be penalized for the IRA contribution. So going forward, before I make any more contributions to my IRA, I will check in with my accountant to see if I can do so without penalty.

- I don’t have to pay US self employment tax (even though TurboTax told me I did!), and I don’t have to file a US state tax return. I’d been paying that self employment tax the past couple years despite not owing any US taxes, so I’m extremely glad that I didn’t make the same mistake this year!

If you’re a US citizen living and working abroad, I can definitely recommend Taxes For Expats for sorting out your US expat taxes. They are super easy to work with no matter where you are in the world, very transparent about what they do and how much they charge for it, and might even be able to save you some money on your tax returns.

Going forward, my plan for tackling my twice-annual tax returns as an American expat permanently residing in Australia is to work with Taxes For Expats for my US tax return, and a local accountant in Sydney for my Australian tax return.

If you want to give Taxes For Expats a try, sign up using this link and you’ll get $25 off your first tax return with them!